Simple Interest Formula

Lesson Objective

In this lesson, we will learn about the simple interest formula and the maturity value formula...

About This Lesson

In this lesson, we will:

- Learn about the basics behind simple interest.

- See the steps to derive the simple interest formula. (1st math video).

- See the steps to derive the maturity value formula. (2nd math video).

The study tips and math video below will explain more.

Study Tips

Tip #1

The formula for finding the simple interest, I is given below:

Where:

- P is the principal (the amount of money borrowed)

- r is the interest rate (per year or per annum)

- t is the loan duration in years.

Tip #2

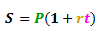

The formula to find the maturity value, S is given below:

Where the definition for P, r and t are the same as above.

The math videos below will explain the basics and the steps to derive these two formulas. You can see the examples on using these formulas here.

Math Video

Video on Simple Interest Formula

Sponsored Links

Math Video Transcript

SIMPLE INTEREST FORMULA

00:00:04.170

In this lesson, we will learn about simple interest formula.

00:00:09.200

Let's say that we have a loan of $5000, with an interest rate of 10% per year, and the loan duration is 3 years. Calculate the loan's simple interest.

00:00:23.120

Now, the 'interest' is the amount of extra money we need to pay, for using the loan.

00:00:29.230

Therefore, it is very important to learn how to calculate the interest of a loan. Here’s how.

00:00:36.180

Since we are calculating simple interest, the amount of extra money we pay is the same every year.

00:00:43.210

To show this, let's represent the principal, $5000, with this green bar. Now, after the 1st year, the interest is 10% of the principal, which is equals to $500.

00:01:00.070

Here, how do we get this $500? To calculate it, we simply multiply $5000, with the interest 10%.

00:01:10.120

10% is the same as, 10 over 100.

00:01:16.060

By multiplying $5000 with 10 over 100, we will get $500. So, that is how we can calculate for the interest, $500.

00:01:16.060

Next, after the second year, the interest is again 10% of the principal, which is another $500.

00:01:39.060

Here, we can see that, the total interest for the first year and second year is $1000.

00:01:47.090

Similarly, after the 3rd year, the interest is again 10% of the principal, which is another $500.

00:01:56.070

Since this is a 3 year loan, the total interest that we need to pay is, $500 + $500 + $500, which is $1500.

00:02:07.200

In other words, this is the total amount of extra money that we need to pay for using the loan.

00:02:15.110

After understanding how simple interest works, let's derive the simple interest formula.

00:02:22.140

First, let's change the principal to P, and the interest rate per year to r.

00:02:30.100

By doing so, we can see that this $5000 becomes P, and this 10% becomes r.

00:02:38.240

Now, P multiply with r, gives Pr.

00:02:44.000

From here, we can see that this $500 can be represented with Pr. Therefore, we can represent each of these $500 as 'Pr'.

00:02:56.200

Now, adding these terms together gives, 3Pr. Hence, we have, the interest I, equals to 3Pr. Let's rewrite it here.

00:03:11.050

Notice that, the number 3 here, is actually the loan duration.

00:03:16.240

So, when we change the loan duration to T years, we get, I = tPr. Next, we can shift this t back. By doing so, we get, I = Prt.

00:03:32.180

With this, we have the simple interest formula, I = Prt.

00:03:39.240

That is all for this lesson. Try out the practice question to further your understanding.

Video on Maturity Value Formula

Sponsored Links

Math Video Transcript

MATURITY VALUE FORMULA PART 2

00:00:03.210

After understanding the basics behind simple interest, we can now learn about the maturity value formula.

00:00:11.190

Consider a loan with the principal 'P', with interest rate per year of 'r'%, and the loan duration is 't' years.

00:00:20.130

Derive the maturity value formula.

00:00:24.140

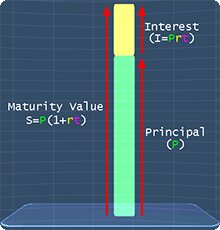

Now, the maturity value is the total amount of money that we need to pay back, after the loan duration.

00:00:31.240

To explain this, let's represent this green bar as the loan's Principal.

00:00:37.190

And, represent the yellow bar as the loan's interest.

00:00:42.190

Now, we can find the total amount of money to pay back, by adding the 'principal' together with the 'interest'.

00:00:51.240

Knowing this, we can write the equation, maturity value, equals to principle, plus interest.

00:00:59.230

Next, let’s represent the maturity value as S, principle as ‘P’ and interest as ‘I’.

00:01:08.210

Now, from the previous lesson, we learn that the simple interest, I=Prt. Therefore, we can change this, I to Prt.

00:01:23.060

Notice that, these 2 terms, have 'P' as a common factor.

00:01:29.060

Hence, we can factorize these terms, by taking out ‘P’ in each term.

00:01:35.240

By doing so, we get, P(1+rt).

00:01:42.060

Finally, we have the formula for maturity value, S=P(1+rt).

00:01:50.200

That is all for this lesson. Try out the practice question to further your understanding.

Practice Questions & More

Multiple Choice Questions (MCQ)

Now, let's try some MCQ questions to understand this lesson better.

You can start by going through the series of questions on simple interest choice of question below.

- Question 1 on the using the simple interest formula

- Question 2 on using the maturity value formula

Site-Search and Q&A Library

Please feel free to visit the Q&A Library. You can read the Q&As listed in any of the available categories such as Algebra, Graphs, Exponents and more. Also, you can submit math question, share or give comments there.